Mortgage rates in 2024: How will rates change in the next upcoming year?

Most experts say that rates will fall in 2024, but when exactly will that happen? We have an idea based on the Mortgage Bankers Association, Fannie Mae, and the National Association of Realtors. According to Business Insider, we have some projected rates for 2024, here they are:

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | |

| Mortgage Bankers Association | 6.8% | 6.6% | 6.3% | 6.1% |

| Fannie Mae | 7.1% | 7.0% | 6.9% | 6.7% |

| National Association of Realtors | 6.1% | 6.0% | 6.0% | 6.0% |

There is still debate on how much the rates will drop, but we know that it will most likely drop back below 7% sometime in 2024.

Should I wait for mortgage rates to drop before buying a house?

Mortgage rates have been at an all-time high in the last twenty years, some optimistic homebuyers have decided to wait for lower rates before house shopping. However, that is not the best strategy because there are some advantages to buying a home right now.

Why are mortgage rates so high?

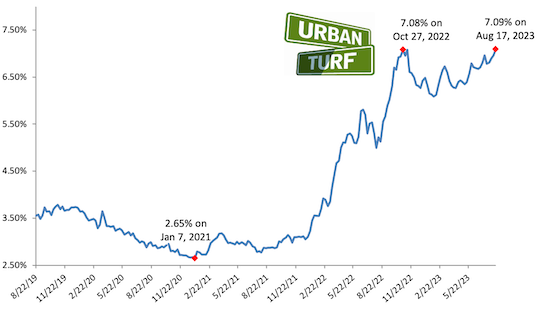

Rates started climbing in 2022 due to inflation. To counter rising prices the Federal Reserve has been hiking the federal funds rate, which has also contributed to elevated mortgage rates.

Ever since June 2022, inflation has slowed down quite a bit. The Federal Reserve’s goal is to keep inflation down, at an annual rate of 2%. The Central Bank announced that it would keep rates high until the goal is achieved.

If the Fed decides to lower rates this year or in 2024, mortgage rates will likely come down. For now, rates aren’t likely to drop by a substantial amount.

How does the Federal Reserve counter inflation and how will Mortgage rates be affected in 2024?

The Federal Reserve has several tools at its disposal to implement monetary policy, and one of the key instruments is the federal funds rate. The federal funds rate is the interest rate at which banks lend money to each other overnight. By adjusting this rate, the Federal Reserve aims to achieve its dual mandate of stable prices and maximum sustainable employment.

When the Federal Reserve raises the federal funds rate, it becomes more expensive for banks to borrow money, leading to higher interest rates throughout the economy. Conversely, when the Fed lowers the federal funds rate, it becomes cheaper for banks to borrow, resulting in lower interest rates.

Changes in the federal funds rate can have a cascading effect on various interest rates, including mortgage rates. Mortgage rates tend to move in sync with the yields on government bonds, such as the 10-year Treasury note. When the Federal Reserve raises interest rates, bond yields often rise, leading to higher mortgage rates. Conversely, when the Fed lowers interest rates, bond yields may fall, resulting in lower mortgage rates.

It’s important to note that mortgage rates are also influenced by other factors, such as inflation, economic growth, and global economic conditions. Additionally, market forces and investor sentiment play a role in determining mortgage rates.

To get a more accurate understanding of potential Federal Reserve actions and their impact on mortgage rates in 2024, it’s recommended to stay informed about economic indicators, Federal Reserve statements, and other relevant factors as the year progresses. Financial experts and analysts often provide insights based on the latest economic data and developments.

How will Mortgage rates affect buying a home?

some general information on how mortgage rates might typically affect the home-buying process, and some factors that could influence rates in the future:

Economic Conditions: Mortgage rates are often influenced by the overall health of the economy. In times of economic growth, rates may rise as central banks seek to prevent inflation. Conversely, during economic downturns, central banks may lower rates to stimulate borrowing and spending.

Inflation Outlook: Inflation is a key factor influencing interest rates. Central banks often adjust rates in response to inflationary pressures. If inflation is expected to rise, central banks may raise rates to cool economic activity.

Central Bank Policies: The policies of central banks, such as the Federal Reserve in the United States, play a crucial role in determining short-term interest rates. Changes in the federal funds rate can have a ripple effect on other interest rates, including mortgage rates.

Global Economic Factors: Global economic conditions, geopolitical events, and financial market dynamics can also influence mortgage rates. For example, if there are global economic uncertainties, investors may seek the safety of government bonds, affecting interest rates.

Housing Market Conditions: The supply and demand dynamics in the housing market also play a role. In a strong seller’s market with high demand and limited inventory, even if mortgage rates rise, home prices may still be driven up due to competition.

To understand how mortgage rates might affect buying a home in 2024, it’s important to stay informed about economic indicators, central bank policies, and global events as the year progresses. Financial analysts and experts regularly provide insights into potential trends based on the latest economic data and developments.

Consider consulting with a financial advisor or mortgage professional who can provide personalized advice based on your specific financial situation and the prevailing market conditions at the time you’re considering buying a home.

If you are looking to buy real estate records or titles please visit our website – https://www.ustitlerecords.com/search-property-records/